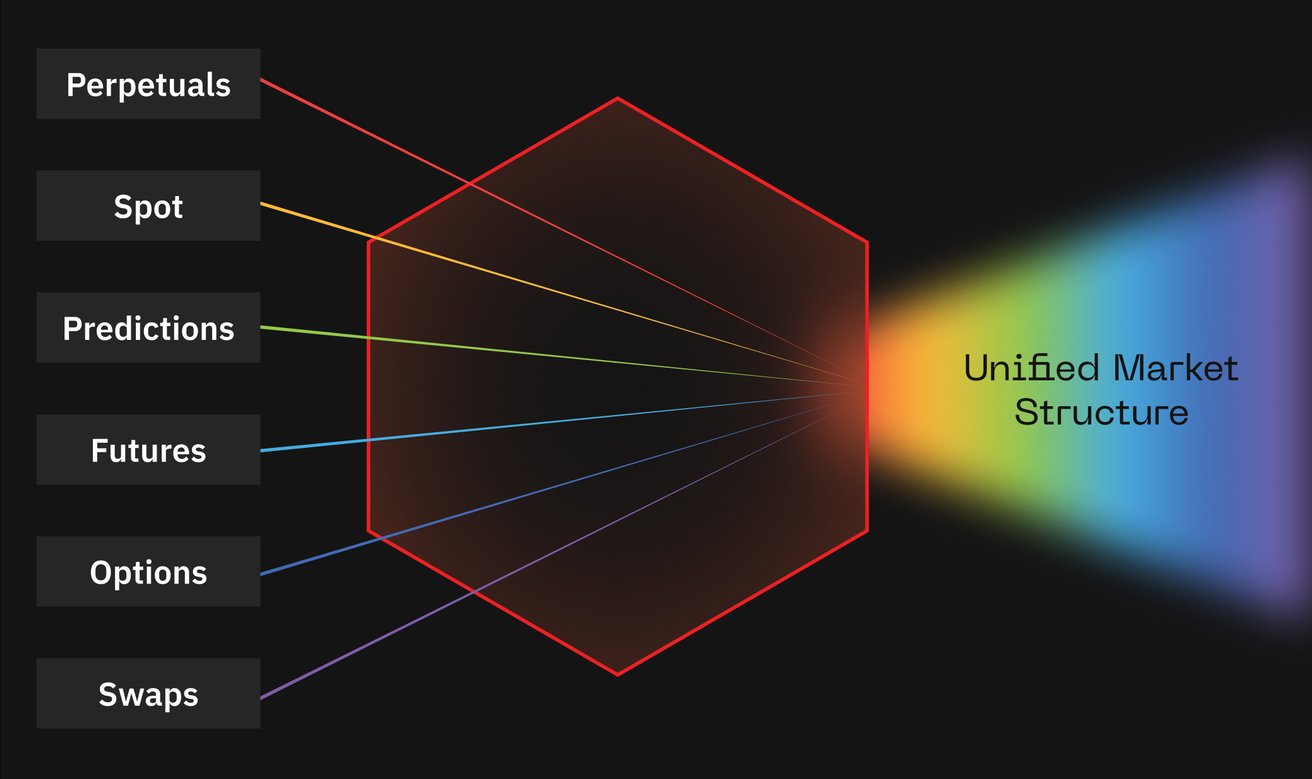

In 2025, U.S. Derivatives Exchanges (DCMs) have expanded beyond traditional futures, options, and swaps to include perpetuals, leveraged spot crypto, and prediction contracts, a massive expansion converging all trading under one mega market structure license.

For more than a century, U.S. derivatives markets have evolved into the most trusted and resilient financial system in the world. All these products, futures, options, swaps, and now the new additions, trade on DCMs and clear through DCOs. This dual framework ensures transparent price discovery and systemic risk management across all market types.

Now, with the rise of crypto assets and new market types like perpetual contracts and prediction markets, the U.S. can integrate these innovations into the same proven framework with previously untapped statutory capabilities. Spot crypto, perpetuals, and prediction contracts are not outliers; they are part of a growing convergence into the DCM + DCO model: the ultimate market structure.

Why Convergence Matters

When all markets like futures, options, swaps, spot, perpetuals, and predictions converge into a single framework, three benefits emerge:

-

Unified Liquidity Pool: Instead of siloed venues with fragmented liquidity, participants can access deeper, more efficient markets. The same collateral and margin can be used across products, enabling efficient capital use.

-

Universal Protections: The DCM+DCO framework brings a consistent layer of governance, transparency, and surveillance. Retail and institutional participants alike can trust that markets are run fairly, with protections against manipulation, biased matching, or hidden exposures.

-

Systemic Risk Management: Any time leverage or delayed settlement is involved, systemic risk is introduced. DCOs mutualize and manage this risk across participants so that one failure cannot cascade into a crisis. This is the backbone of the U.S. futures and options markets.

The Role of Spot Crypto, Perpetuals, and Prediction Markets

Congress has already spoken on each of these markets and thus no new legislation is required as they all fit within the Commodity Exchange Act’s statutory framework:

-

Spot Crypto: Section 2(c)(2)(D) of the Commodity Exchange Act already requires leveraged spot crypto trades to be executed on a DCM and cleared through a DCO. Bringing these markets into the framework eliminates the patchwork of state-by-state money transmitter licenses and ensures fair, transparent, all-to-all access.

-

Perpetuals: Globally popular, perpetual contracts perpetually settle to the spot price. Within a DCM + DCO, they can be risk-managed alongside futures and options, benefiting from cross-margining, surveillance, and systemic safeguards.

-

Prediction (Event) Contracts: From elections to weather, prediction markets have long been offered on U.S. DCMs, but are now growing in relevance. As contracts on measurable events, they belong within the DCM + DCO model, where standardized governance and clearing ensure integrity and confidence.

A Superior Market Type

This convergence is not about inventing a new regulatory structure, it is about recognizing that the DCM + DCO framework is the superior market type for all forms of trading where leverage, credit, or systemic risk is present.

Just as futures, options, and swaps standardized under this model, so too can spot crypto, perpetuals, and predictions. The result is a single, unified market structure with consistent rules, protections, and global competitiveness.

Why It’s Good for the U.S.

-

For Customers: U.S. retail and institutional traders gain access to safer, more transparent, and more efficient markets. They can trade new instruments under the same protections that govern futures and options.

-

For the U.S. Economy: A unified market structure consolidates liquidity and strengthens the country’s position as the world’s hub for financial innovation. Offshore fragmentation gives way to onshore leadership.

-

For Stability: By embedding new products into the proven DCM+DCO system, the U.S. ensures that innovation does not come at the cost of systemic safety.

Conclusion

Markets evolve. First futures and options, then swaps. Today crypto, perpetuals, and prediction contracts. But the destination is the same: the DCM + DCO framework.

This convergence creates the most efficient, transparent, and resilient market structure possible. By uniting all products under one regulatory architecture, the U.S. delivers both innovation and protection.