Bitnomial Exchange launched the first U.S. perpetual futures, marking the convergence of the global crypto perpetual futures market and the U.S. traditional futures industry.

Perpetual futures have become a foundational trading instrument in global crypto markets, offering deep liquidity, leverage, and tight pricing by linking spot and derivative markets through continuous convergence. However, until recently, such instruments were absent from U.S. markets due to perceived regulatory incompatibility.

Market Convergence

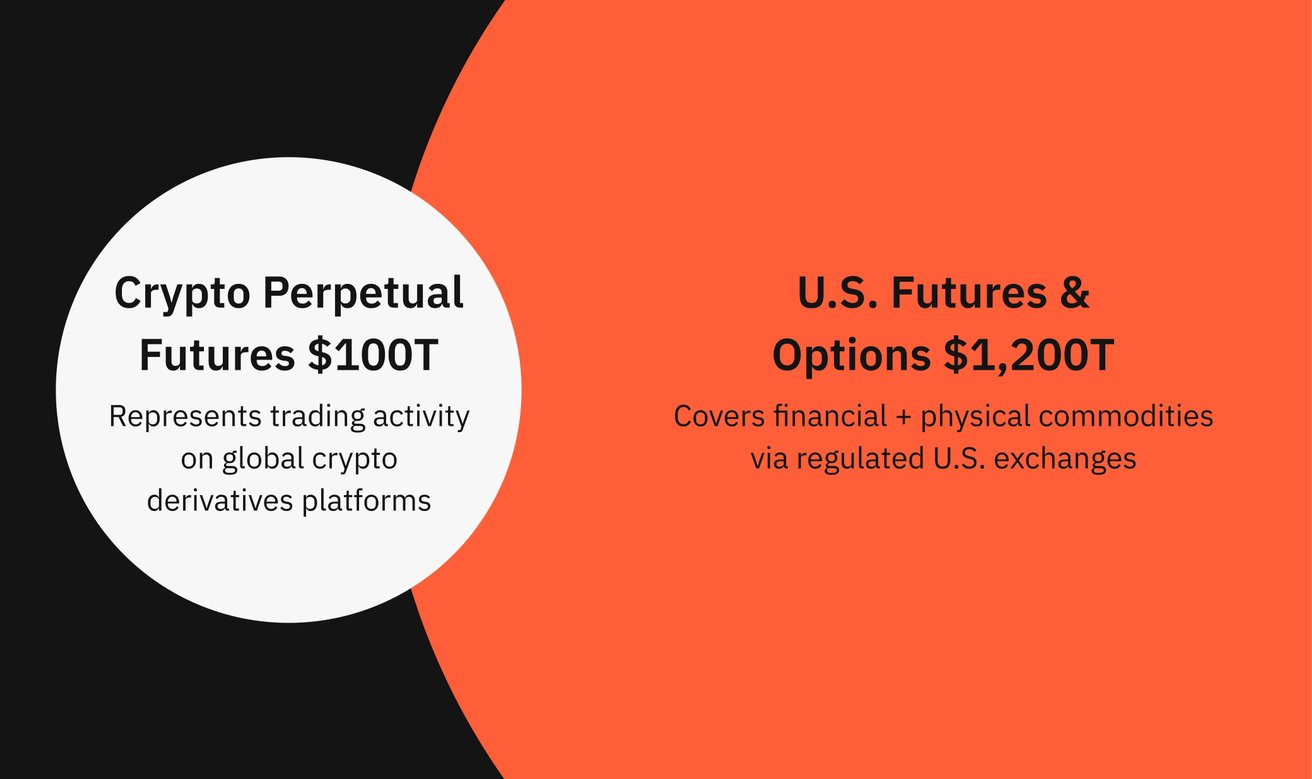

This development represents convergence between the global crypto perpetual futures market (over $100 trillion annually) and the U.S. futures and options markets (over $1.2 quadrillion annually). With perpetual contracts now accessible under U.S. jurisdiction, the model may be extended to crypto, equities, rates, commodities, and FX.

Understanding Perpetual Futures

Perpetual contracts are defined by real-time alignment with spot market pricing, supported by:

- Floating Basis

- Periodic Funding Rate

- Interest Rate Adjustment

These mechanisms allow futures prices to track spot prices continuously, rendering expiration-based convergence unnecessary.

Key Mechanisms

A floating basis permits temporary divergence between spot and futures prices, reflecting market demand for long or short exposure. The funding rate drives convergence by compensating the counterparty.

Interest rate adjustments account for the cost of capital embedded in spot positions. Without this feature, market makers may provide unpriced credit, distorting incentives and reducing liquidity.

Liquidity Consolidation

Perpetual futures concentrate liquidity by:

- Unifying spot and derivative market liquidity into a single instrument

- Eliminating expiration fragmentation and contract rollovers

This results in narrower spreads, reduced transaction costs, and increased efficiency.

Bitnomial's Implementation

| Feature | Bitnomial Perpetual Futures |

|---|---|

| 8-Hour Funding Rate | Yes |

| Floating Basis | Yes |

| Interest Rate Adjustment | Yes |

| Economic Parity with Offshore | Yes |

| Frequent Expiration | No (25-Year) |

| Monthly Fees | No |

Bitnomial's perpetuals use an 8-hour funding interval, aligning with global trading sessions. The 25-year term minimizes roll activity, allowing for continuous exposure. Traders can post crypto as margin collateral, enabling capital-efficient positions without converting to fiat.

Alternative Designs

Other platforms offer instruments that differ from Bitnomial's perpetual futures:

| Feature | Bitnomial | Perpetual-Style | Spot-Quoted |

|---|---|---|---|

| 8-Hour Funding Rate | Yes | No (1-Hour) | No |

| Floating Basis | Yes | Yes | No |

| Interest Rate Adjustment | Yes | No | No |

| Economic Parity with Offshore | Yes | No | No |

| Frequent Expiration | No (25 Years) | Yes (5 Years) | Yes (1 Year) |

| Monthly Fee | No | No | Yes (Monthly) |

Some models use shorter funding intervals and omit interest rate adjustments, while others resemble long-dated synthetic spot instruments with fixed expirations and maintenance fees.

Summary

Bitnomial's approach replicates the full economic design of offshore perpetuals, adapted for U.S. regulatory compliance. This implementation brings core perpetual futures mechanics to a regulated venue, positioning the product as a foundation for broader shifts in futures contract design across all asset types.