The ETF Approval Fast Lane

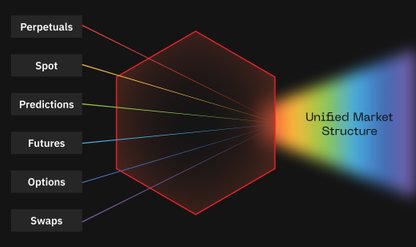

The SEC's generic listing standards compressed crypto ETF timelines from 240 days to 75, but the real story is the infrastructure that made it possible. For any token that wants an ETF, the path now starts on a DCM.

March 02, 2026